Big BRNDZ for Lifetime Returns…

The primary aim of the AnBro World’s Biggest Brands Portfolio (JSE Code: BRNDZ) is to invest in companies that have demonstrated proven success and longevity over time. In most cases, these are companies that are well known to us. We use or interact with them on a daily basis and in many cases, our lives are intricately intertwined with them. The necessity of their products or services to our everyday lives makes them loved and respected and ensures our loyalty and continued use of them. This in itself creates a moat and competitive position which is envied by many. Over and above this the features demonstrated by these companies and their products can be surmised as follows:

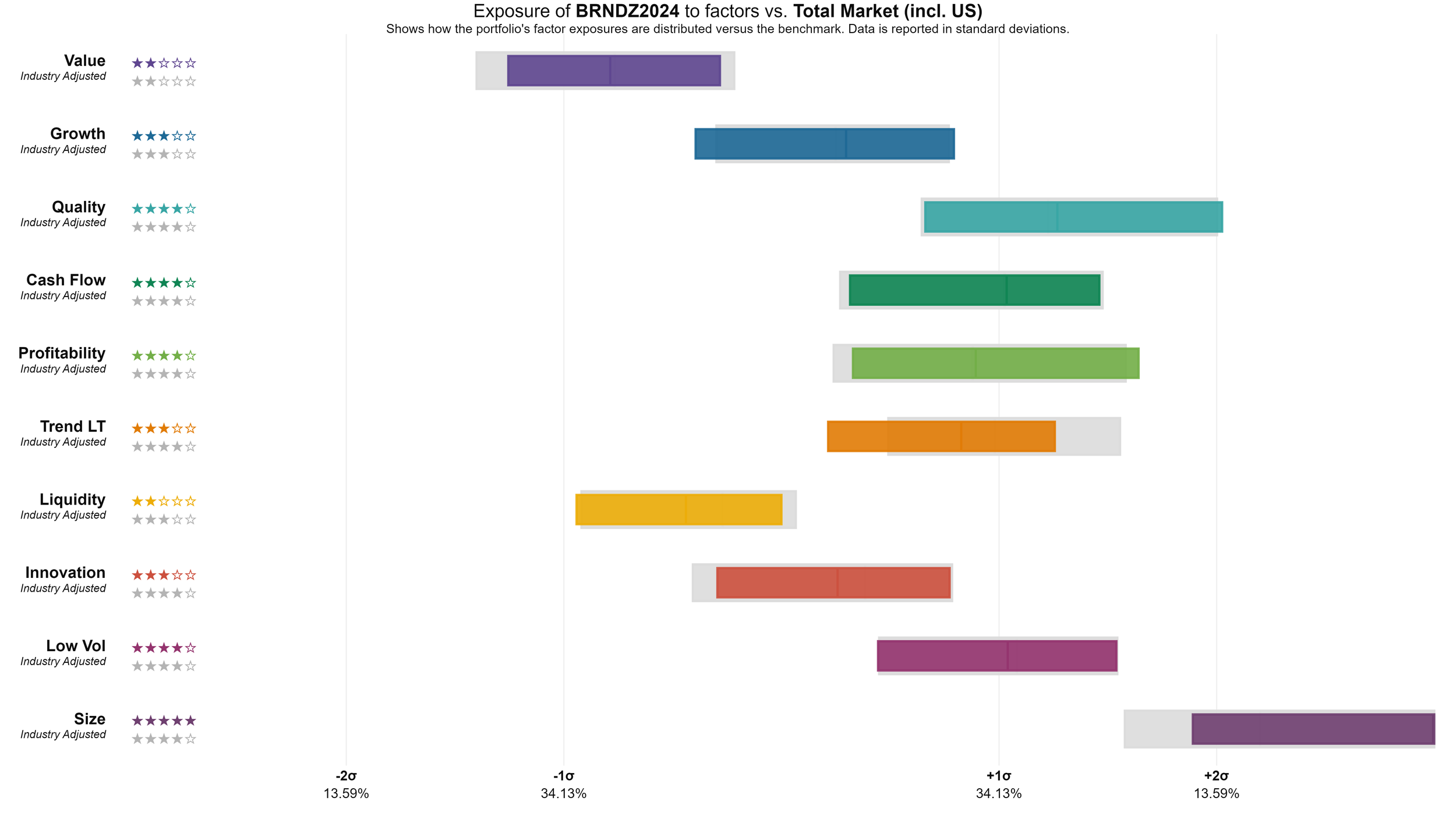

Stability and Reliability. Their longevity is testament to their ability to survive multiple economic cycles and downturns. They oftentimes emerge from economic crises stronger than they went into them. This increases their appeal and safety.

Global Presence. Due to their size and scope these businesses are diversified across the world. This provides a nice mix of both First World and Emerging Market exposures, which adds both solidity and growth potential to the business in question and the portfolio at large.

Cash Flows. Strong Brands invite continued and ongoing purchases and steady margins. This is converted into strong cash flows which can be used for multiple opportunities including reinvesting in growth, share buy backs and of course dividends. Their consistent steady growth profile allows for the type of optionality that many other companies don’t have the luxury of such as investment in R&D, innovation and expansion into new markets.

Brand Loyalty. Brand loyalty entrenches a competitive position in the market place as well as a perception of value that allows companies the type of flexibility required to raise prices, experiment with new products or markets and to extend the reach and strength of the brand in question. This usually allows for the maintenance of and even the continued growth of market share and presence.

Liquidity. Large Brands are by nature large companies too, their shares are listed on and traded on multiple markets and are incredibly liquid as a result. This liquidity ensures ease of trade and access to capital when selling is required.

Blue Chip status. Many of the worlds biggest brands are considered blue chip in nature. Blue Chip stocks are known for their quality, reliability, strong financial position and performance. They usually form the foundation and cornerstone of any well diversified investment portfolio.

Lower Volatility. Large well respected companies often tend to demonstrate lower volatility than smaller, riskier or more cyclical companies. Their size and stability helps reduce the emotional stress associated with investing and occasional stock market turmoil that happens from time to time.

![2024-03-06 - asset allocation drill-down of [BRNDZ2024].png](https://images.squarespace-cdn.com/content/v1/64a6d32fc3aa1146e7d68976/84ed3ea0-d41f-417d-83ac-473c9e3a660d/2024-03-06+-+asset+allocation+drill-down+of+%5BBRNDZ2024%5D.png)